A money diary is a valuable tool for tracking and managing your personal finances. It helps you become more aware of your spending habits, identify areas where you can cut back, and ultimately improve your financial well-being. Here’s a step-by-step guide on how to write a comprehensive money diary:

Choose a Medium

Decide whether you want to keep your money diary in a physical notebook, a digital document, a mobile app, or a specialized budgeting tool. The choice depends on your personal preference and convenience.

Set Up the Diary

Create a dedicated section or document specifically for your money diary. If you’re using a digital platform, you can create different sections or categories for income, expenses, savings, and investments.

Determine the Timeframe

Decide whether you want to track your finances daily, weekly, or monthly. Daily tracking offers the most detailed insights, while weekly or monthly tracking might be more manageable for some people.

Record Your Income

Start by documenting all sources of income. This includes your salary, freelance earnings, side gigs, rental income, and any other money that comes into your possession.

Categorize Your Expenses

Create categories to classify your expenses. Common categories include housing, utilities, transportation, groceries, dining out, entertainment, health, and miscellaneous. Tailor these categories to your lifestyle.

Track Every Expense

Record each expense, no matter how small. Be diligent and honest in documenting where your money goes. Include cash expenditures, credit card transactions, and digital payments.

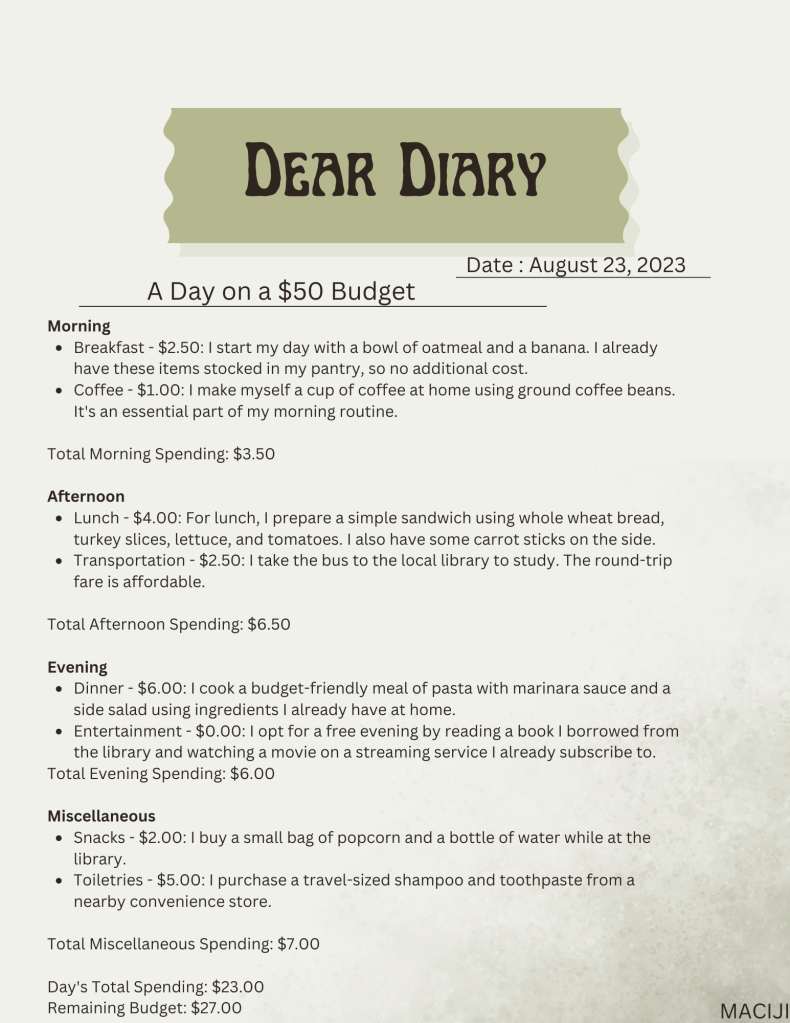

Note the Details

For every expense, jot down details such as the date, description of the expense (e.g., “coffee at Starbucks”), amount spent, and the category it falls under.

Be Specific

Rather than simply noting “dining out,” specify the restaurant and the items you ordered. Specifics will help you understand your spending patterns better.

Reflect on Your Spending

Regularly review your money diary. Look for patterns and trends. Are you overspending in certain categories?

Calculate Totals

At the end of your chosen timeframe (day, week, or month), calculate the total income and total spending. Most digital tools or apps will do this automatically for you.

Analyze and Reflect

Compare your income and expenses. Are you living within your means? Are there expenses that surprise you or that you consider unnecessary?

Set Goals

Based on your analysis, set financial goals. These could include reducing spending in specific categories, increasing savings, or paying off debts.

Create a Budget

Using the insights from your money diary, create a budget. Allocate a specific amount to each expense category and stick to it as closely as possible.

Keep Improving

Continue tracking your finances and using your money diary to adjust your spending habits. The more you do it, the more aware and in control you’ll become.

Be Patient

Improving your financial habits takes time. Don’t get discouraged by occasional slip-ups. Use setbacks as learning opportunities.

Leverage Technology

Consider using budgeting apps and tools like Mint, YNAB (You Need A Budget), or PocketGuard. These platforms can automate much of the tracking and categorizing process.

Stay Consistent

Consistency is key to success. Make money diary writing a routine part of your day or week.

Review Regularly

Schedule regular reviews of your money diary to track your progress towards your financial goals and make necessary adjustments.

A money diary can be a powerful tool in achieving financial stability and growth. Remember, the goal is not just to record your transactions but to gain insights and make informed decisions about your finances.