Managing personal finance has become a very difficult task in the era of digital finance. Among many budgeting tools available, You Need A Budget (YNAB) stands out for its unique approach and powerful features to enable users to achieve financial stability and freedom. This article explores how the YNAB app facilitates effective financial management, transforming budgeting into an empowering activity instead of a mundane chore.

Image Source: ynab.com

Understanding YNAB

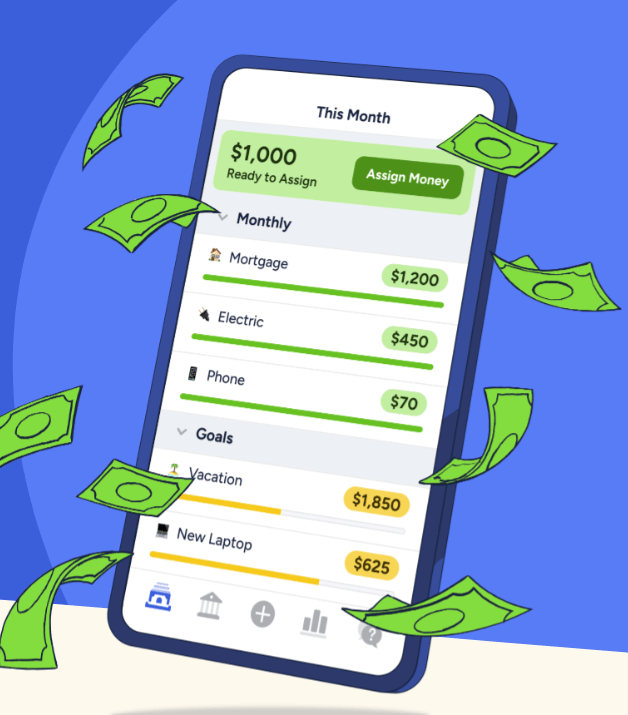

One principle that drives YNAB is that every dollar should be given a job. With this method, all income dollars are assigned purposes such as bills, savings, or leisure expenditures. Unlike conventional budgeting tools that focus on tracking expenditure history, YNAB advocates for proactive budgeting where users make plans before spending to align it with their set objectives.

Key Features of YNAB

Zero-Based Budgeting: YNAB employs a zero-based budgeting system whereby users allocate their incomes to specific categories until no unallocated money remains. Through this technique, informed spending choices can be made, and money is not wasted or misplaced.

Real-Time Sync: The app supports real-time synchronization across multiple devices allowing couples to see eye to eye on their finances at any time. It is most useful for families having joint expenses.

Goal Setting and Tracking: For instance, vacation saving, emergency fund building, and debt settlement are some of the financial goals that can be set by the user through YNAB. These goals are then monitored by the application while giving visual feedback that could be motivating or informative about how far they have come.

Debt Paydown Tools: In case one wants to free themselves from debts, they will find specialized tools for prioritizing debt repayment in YNAB helpful. By dealing with high-interest loans first and allocating extra funds towards debt payment, users can reduce their debt burden systematically.

Comprehensive Reporting: There are detailed financial records in terms of expenditure behavior over time, income trends as well as net worth. These assist in finding areas that have room for cutting down or adjusting expenditures to achieve financial purposes.

Benefits of Using YNAB

Improved Financial Awareness: One of the most significant benefits of using YNAB is the increased financial awareness it brings. By consistently keeping track of income and expenses, users can develop a clearer sense of their finances, which is the first step towards effective money management.

Stress Reduction: Financial stress is a common issue, but YNAB’s structured approach to budgeting can alleviate this stress. The app offers a systematic way for planning income and expenditures so that people feel more in control of their finances and at the same time reduces anxiety and uncertainty.

Encourage Saving: By setting goals, users can save more with this tool than with any other means. The short-term needs as well as long-term objectives should be saved as per the app’s encouragement thereby developing a healthy savings culture.

Adaptable to Change: Life’s changes can be accommodated by YNAB through its flexible budgeting system. This methodology assists users in adjusting with minimal disruption when unexpected bills occur, or earnings decrease suddenly instead of derailing financial plans.

Long-Term Financial Health: By consistently applying YNAB’s principles, users can build a solid financial foundation. The idea behind this application is to promote prudent spending habits, discouraging encumbrance and encouraging saving for investment purposes aimed at securing one’s future financially.

YNAB is more than just an application for budgeting; it is a full money management service that allows users to oversee their finances. YNAB helps its users to create conscious budgets, set financial goals, and plan accordingly, which teaches them how to manage their finances better in the long run and ensure peace of mind too. YNAB offers all the necessary tools and guidance required when you are either struggling to make ends meet or would like to develop your financial strategies.